Providing Financials

The Next Step After Closing the Books

With your books fully updated and closed, it’s time to deliver your financial reports. These reports aren’t just numbers on a page—they’re the insights that guide smart decisions for your business. But before diving in, let’s break down what “financials” really mean.

Income Statement (Profit & Loss)

The Income Statement is where most business owners naturally focus. It feels familiar and straightforward—but the numbers can sometimes be surprising (cue the “That can’t be right!” reaction).

Shows your revenue, expenses, and profit or loss over a specific time period

Answers the question: Are we making money?

Balance Sheet (The Mysterious One)

Often the most misunderstood report, the Balance Sheet reveals your business’s overall financial position. Don’t worry—I’ll walk you through it until it makes total sense.

Summarizes what the business owns (assets), owes (liabilities), and what remains (equity) at a given point in time

Answers the question: What is the financial health of the business?

Cash Flow Statement

The Cash Flow Statement is sometimes overlooked, but it’s just as important—especially when managing cash is a top priority.

Tracks the inflow and outflow of cash

Answers the question: Do we have enough cash to pay the bills?

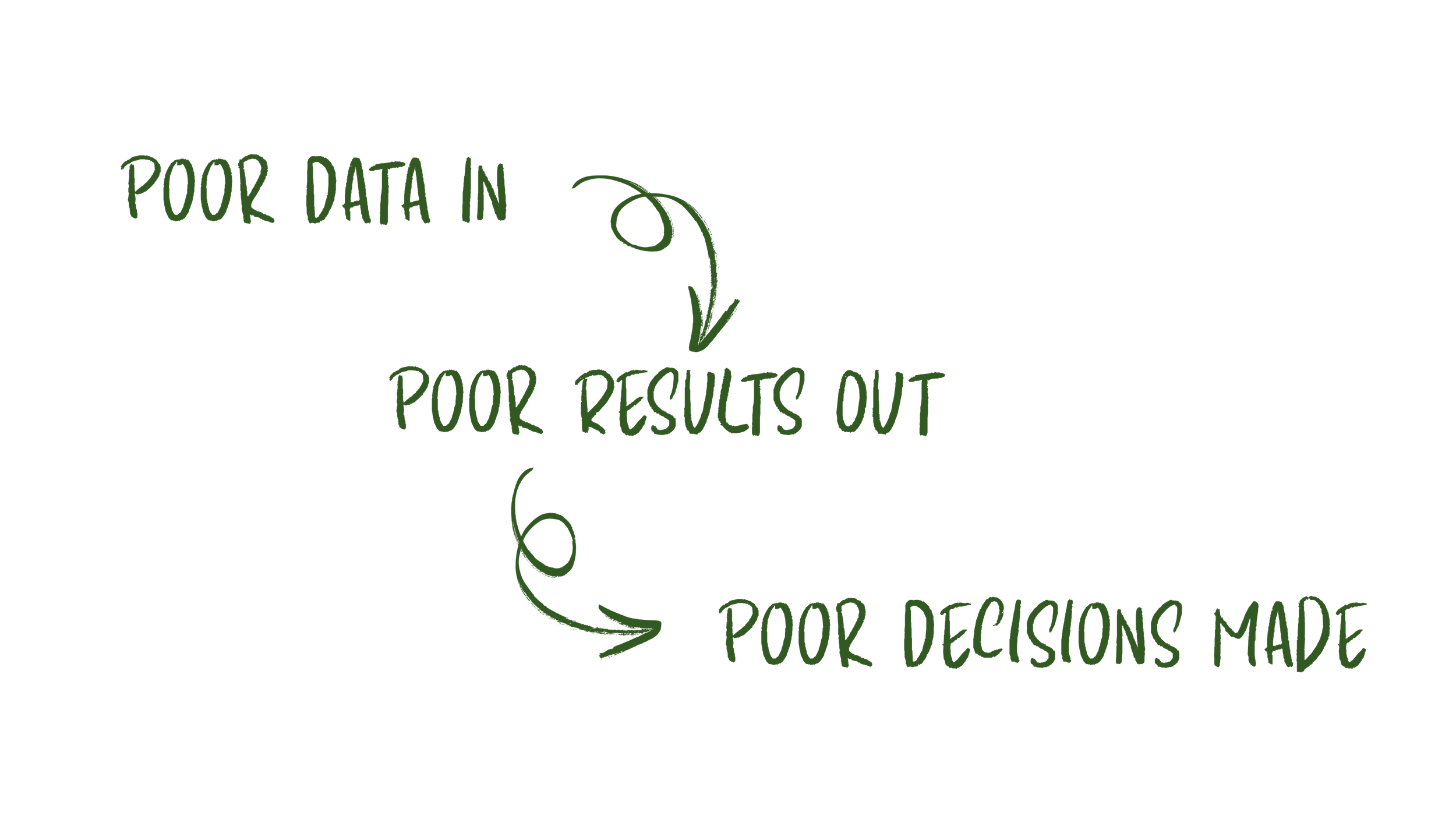

Why Data Quality Matters

No matter which report you’re looking at, the bottom line is this: the quality of your financials depends entirely on the quality of the data entered.

That’s why I emphasize consistency and precision from the very first transaction. Together, we aim for gold—not garbage.